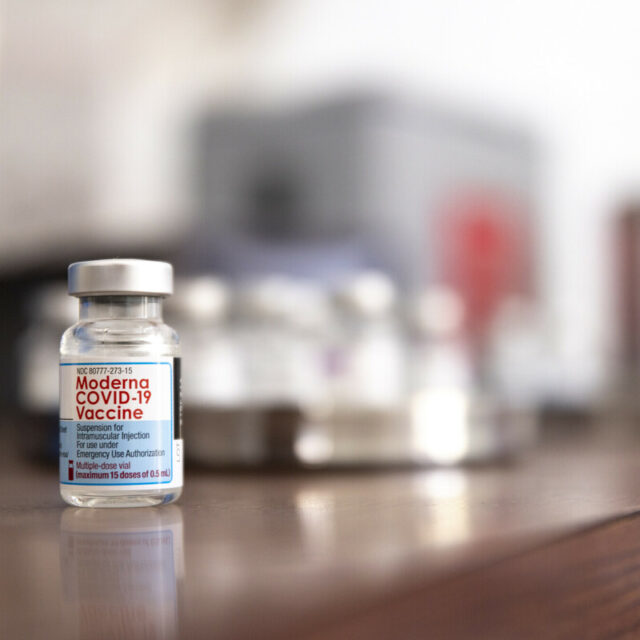

The World Bank estimates that COVID-19 could push between 143 and 163 million people into extreme poverty around the world in 2021, including nearly 50 million people in sub-Saharan Africa. And the pandemic could end up costing the global economy more than US$22 trillion by 2025 — roughly US$10 billion a day — compared to pre-pandemic projected growth.

To combat the pandemic, advanced economies have moved fast to pre-order vaccines and pump trillions of dollars to shore up national economies. But poorer countries have not had the ability to respond anywhere near to the same scale. G20 countries have kept their economies afloat through stimulus packages that were worth nearly 19% of gross domestic product (GDP), while low-income countries have only been able to spend less than 2% of GDP. This has led to a divergence of outcomes and an uneven global recovery.

In order to put an end to the pandemic everywhere and ensure a global recovery, ONE is asking the G20 for an economic response package for vulnerable countries. This package should include a new allocation of US$650 billion in Special Drawing Rights and a mechanism for wealthy countries to transfer a portion of their SDRs to the most vulnerable countries.

Let’s break down what exactly this means and what SDRs actually are.

What are SDRs?

Special Drawing Rights are a type of reserve asset issued by the International Monetary Fund to all countries to supplement countries’ official reserves. SDRs are not cash, but they can be traded for hard currency such as dollars, pounds, or euros.

How can they be used?

SDRs are a useful tool to plug fiscal gaps, meet external debt obligations, or address foreign exchange shortages. For example, if Liberia is facing a foreign currency shortage, its central bank can voluntarily sell a portion of its SDRs to its British counterpart in exchange for the pound sterling to shore up its reserves or to pay for imported goods, such as medical supplies.

Why is a new allocation of US$650 billion in SDRs important for COVID relief?

The pandemic has wreaked havoc on government finances in low-income countries. Revenues have dried up. Dramatic declines in commodity prices, tourism, and remittances — as well as capital flight — have resulted in huge budget shortfalls and limited access to foreign currency. Most developing countries rely heavily on imports for basic goods, which they primarily pay in US dollars and euros.

Rich countries have monetary tools and resources — including stable currencies and sizable foreign exchange reserves — that allow them to protect their economies during economic downturns like we’re experiencing with the pandemic. Most low-income countries do not have these resources, so SDRs are a way to give them access to foreign currency, which they can use to purchase goods. A new SDR allocation is the best way to quickly get a financial boost to the most vulnerable countries, and it does not require significant new budget resources for wealthier countries.

How have allocations worked before?

The IMF issuing a new allocation of SDRs is the closest it comes to printing new money. In order to maintain stable global reserves, SDRs have been fairly level since they were first created in 1969. However in 2009 in the wake of the global financial crisis, a general allocation of US$250 billion in SDRs was approved by the IMF Board. Some 20 developing countries used most of these new SDRs within a year to help withstand the economic fallout.

Why is ONE also asking for a re-allocation of SDRs?

Any new allocation of SDRs is divided up between countries based on their IMF quota size, which is essentially based on the size of countries’ economies. This means that wealthier countries will get the majority of SDRs while poorer countries will only get a small share. In the case of a new US$650 billion allocation, the G20 would get 68% of the SDRs (about US$443 billion), while African countries would only get about 5% of the SDRs (US$33 billion). While this $33 billion would be a helpful boost to African countries, it is less than 10% of the US$345 billion financing gap they face between 2020 and 2023.

| IMF quota % of total | Distribution of a potential new $650bn SDRs allocation | |

| G20 countries | 68.12% | $442.8 billion |

| G7 countries | 43.50% | $282.8 billion |

| African countries | 5.12% | $33.3 billion |

| DSSI-eligible countries | 4.21% | $27.3 billion |

Wealthier countries don’t actually need the additional SDRs, since they have access to a broader range of monetary tools and reserve cash. That’s why a re-allocation is required.

What are the next steps?

We are asking IMF member countries—including G20 countries— to quickly agree on a new SDR allocation and to vote to approve the allocation. Once approved, we want countries to agree on a reallocation mechanism, and a target for the proportion of new SDRs to be reallocated that is commensurate with the financial need of developing countries.

What’s at stake if the G20 doesn’t do this?

Just as no one is safe until everyone is safe, we can’t move forward unless we all do it together. The IMF has warned that an incomplete global recovery will endanger the entire global financial system. If all countries do not have access to the liquidity needed to buy vaccines and medical supplies and address COVID’s economic impacts, this will affect all countries through a prolonged global pandemic and disruptions to travel, supply chains, and global trade.