The World Bank predicts the greatest drop in remittances in recent history, with low-income developing countries set to receive US$110 billion less, due to COVID-19 in 2020.

Remittances, which are the cash flows sent home by migrant workers to help their families, are a huge source of finance for low- and-middle-income countries. Last year, these countries received 78% of the US$714 billion that were sent around the world. Global remittance flows were five times higher than official development assistance in 2019 ($153 billion).

Prior to COVID-19, African remittances were on track to reach US$92.1 billion in 2021. They were on track to exceed the combined total of development assistance and foreign direct investment in Africa. It is now estimated that COVID-19 will reduce predicted remittance income by 21% to just US$67 billion in 2020 and US$69 billion in 2021, wiping out six years of growth.

Millions rely on remittances. In Africa, one out of five people send or receive remittances. Remittances are an especially critical inflow because they go directly to the pockets of the poorest families with dire need and who know how best to spend them. It is estimated that three-quarters of the money is used to purchase nutritious food or fund healthcare, education, and housing expenses.

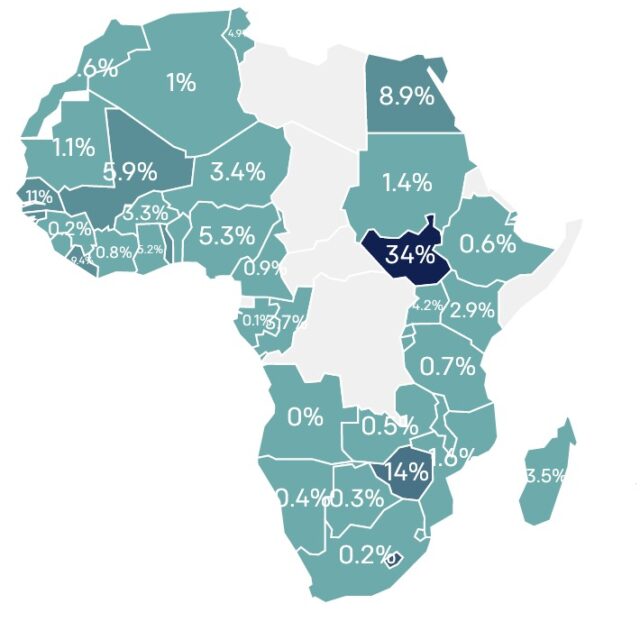

The importance of remittances is displayed in this map, shown as the percentage share of countries’ gross domestic product (GDP) in 2019. The darker the colour, the more significant remittances are to a country’s economy.

For example, the remittances received by South Sudan accounted for one-third of their GDP. Lesotho received 21% of its GDP and the Gambia 15.5% through remittances in 2019. Several African countries receive the equivalent of over 5% of their GDP in remittances.

In 2019, migrant workers sent about US$85 billion to their relatives on the continent of Africa. Remittances sent from Egypt and Nigeria alone account for 60% of remittances received in Africa.

COVID’s impact on remittances

Covid-19 is having a negative impact on remittance flows. Nigeria, which received 28% of remittances sent to Africa in 2019, saw a drop in remittances to the lowest quarterly level since the global financial crisis in 2008. Remittances to the country declined by 43% year-on-year in Q2 of 2020. This decline happened at a time when the impact of COVID-19 was just gathering momentum.

The reasons for Remittances decline are three-fold:

- African migrants living and working in countries most affected by the virus — the US, the Persian Gulf, Europe etc. — are facing job losses, reduction of income, or health risks from working in essential services. The US is the largest source of remittances to Africa, representing 14% of all inflows. Since February unemployment rates in the US have more than tripled, with a significant impact on the amount many migrants may be able to send home.

- Africa’s remittance receivers are also more in need of the cash, as informal workers who rely on them are less able to access jobs at home due to the pandemic.

- Remittance service providers (RSPs) in Africa are encountering difficulties in operating during lockdowns. Households that are sent payments may also lack access to bank accounts or mobile money accounts to receive remittances if cash providers are closed down.

As much as 80% of all remittances transferred to Africa were sent from just 16 countries. Among the largest senders are the United States (14%), Saudi Arabia (12%), France (10%), and the United Kingdom (9%).

A key barrier to sending remittances is their cost. In 2017, it was estimated that US$30 billion was paid by individuals sending remittances in fees. The Sustainable Development Goals called for remittances to cost no more than 3% of their total to send them, meaning it would cost US$6 to send US$200 to a family member. However, there is a long way to go to achieving this goal…

The cost of remittances also remains high within Africa, especially in the following corridors: Tanzania to Uganda; South Africa to Angola; and Angola to Namibia.

How can we protect and support remittances?

- Reduce remittance costs: Bank regulations, including strict “Know Your Customer” regulations, should be relaxed for small amounts, so that sending remittances costs as close to US$0 as possible until migrants and economies can recover from the impact of COVID-19.

- Ensure access to RSPs: Policymakers should increase digitisation of payments and classify Remittance Sending Providers (RSPs) as essential businesses, in order to widen access for those in need.

- Support migrant workers: Governments should put in place better social safety net programs for migrants and remittance receivers to cushion the continued reductions in income for both senders and receivers.

For more, read “Coronavirus disease (COVID-19) and migrant remittances: Protecting an economic lifeline” by the Economic Commission for Africa and ONE Campaign.