The Issues

A Prosperous Partnership for America: The African Development Fund

Since 1976, the United States has been a member of the African Development Fund (ADF or the Fund), the low-cost loan and grant provider within the African Development Bank (AfDB).

As Secretary of State Marco Rubio explained, “places [in Africa] provide an extraordinary opportunity for America to become more prosperous…and vice versa.” The ADF is a proven mechanism to achieve mutual economic growth.

The ADF is one of the most effective vehicles for America’s investments to promote self-reliance and growth. This helps create stable countries that are stronger and more prosperous partners for the U.S.

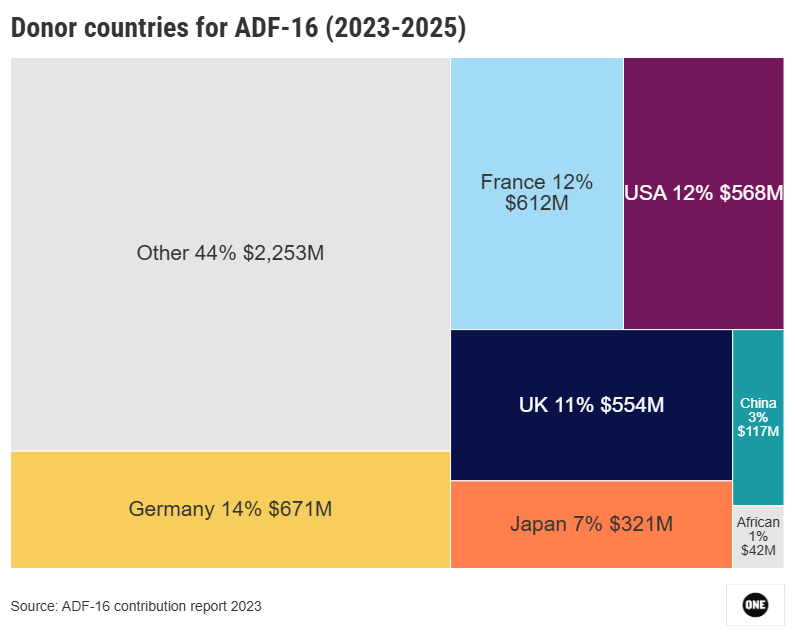

The United States is among the top three contributors to the ADF and continued US investment is critical to continuing the Fund’s successful track record of tackling Africa’s acute development challenges.

What is the African Development Fund (ADF)?

- The ADF invests in 37 African countries through low-cost loans and grants.

- Without the ADF, these low-cost loans might be unaffordable or unavailable.

- The ADF focuses on critical infrastructure that unlocks further economic growth and commerce.

- The U.S. is a top shareholder and through its contributions, helps shape the Fund’s policies, investment priorities, and activities.

- Congress appropriated $197 million for the U.S. contribution to ADF in FY25.

- The ADF maximizes the value of each dollar invested by using contributions and innovative financing to unlock and attract further private-sector investments.

- The Fund provides a hard-to-beat value for American taxpayers: Every dollar of U.S. taxpayer money generates $10 of direct investment in profitable projects according to AfDB estimates.

As Congress negotiates FY 2026 appropriations, we urge lawmakers to protect funding for the African Development Fund, which provides significant return on investment for U.S. taxpayers.

ADF Investments Support America’s Strategic Interests

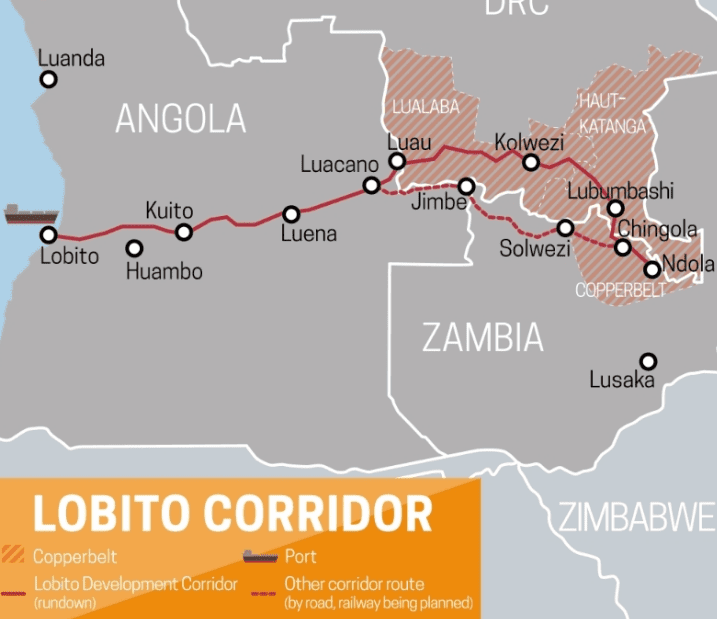

The African Development Bank, including through the ADF, has committed $500 million to build the Lobito Corridor, a rail-and-port trade route to link the Copperbelt in DRC and Zambia to the Atlantic via Angola. This major infrastructure project will create a trade route for an exchange of goods, notably copper and cobalt, to western ports. The Trump administration has called it “extremely important and vital” for the economies of the region and for the United States.

Africa holds about 30% of proven global critical minerals reserves (essential for making batteries, steel, and aluminum). The Lobito Corridor is key to connecting these resources with global markets, including the U.S.

The port of Lomé in Togo is the fourth busiest container port in Africa and, thanks to its deep-water capabilities and modern equipment, has been identified by the U.S. Embassy as an entry point for American companies to access African markets. The African Development Bank funded a new container terminal and the ADF contributed $40.8 million to refurbish the Lome-Cotonou Road, which slashed travel times and will contribute to U.S. goods traveling faster and deeper into West Africa.

A few months ago, I spent 10 days before it was my time to cross.”

Mawdo Saine, Senegalese truck driver

It was not unusual for truck drivers like Mawdo Saine to wait that long for the ferry before the Senegambia Bridge was built, with 70% of the cost funded by the ADF. It reduced transit time from hours (and sometimes days) to just a few minutes and cut truck operating costs by 93%. The removal of this massive logistical bottleneck contributed to increased commercial flows, with U.S. exports to Senegal increasing 23% and to The Gambia 94% since the bridge was built.

Why Should the U.S. Continue Investing in the ADF?

- To realize this potential, large infrastructure investments are needed. The ADF is uniquely positioned to deliver because it is African-focused and African-led, and is already the largest development bank investor in infrastructure on the continent.

- By 2050, 25% of the world’s population will be African, and the ADF is central to the U.S. seizing the opportunities this presents.

- The youngest continent in the world, Africa is the only region where population is expected to grow in the coming decades, becoming one of the world’s biggest markets—a huge opportunity for mutually beneficial commerce including with American business.

- By continuing to fund the ADF, the U.S. would contribute to Mission 300, a transformative initiative that will provide energy access to 300 million people, boosting economic growth and trade opportunities with the continent.

Ending energy poverty through a focus on energy access and security is vital for enabling private investment and boosting growth. The World Bank and African Development Bank’s joint initiative to expand energy access to 300 million more people in Africa is a welcome contribution to this effort.”

Treasury Secretary Scott Bessent, April 2025

The Future of the ADF

- In an unstable global economic environment, marked by rising global debt, reduced official development assistance and conflict, the ADF’s seventeenth replenishment (ADF-17) represents a strategic opportunity to catalyze inclusive growth, create opportunities for jobs and more stable countries.

- Replenished every three years, the ADF will hold its pledging session for its seventeenth replenishment round in December 2025.

- The sixteenth replenishment (ADF-16) mobilized $8.9 billion, the sixteenth replenishment (ADF-16) mobilized $8.9 billion, with Algeria and Morocco joining Angola, Botswana, Egypt, and South Africa as African contributors to the Fund—a milestone reflecting stronger regional ownership. Heading into ADF-17 replenishment, even more African countries are expected to pledge, keeping the commitment to regional ownership.

- To build on the success of previous replenishment rounds, ADF-17 will focus on two key pillars:

- Pillar I: Investment in hard infrastructure such as regional integration, energy, agriculture, water, sanitation, and health.

- Pillar II: Governance, policy dialogue, debt management, and capacity development.

- These strategic pillars will guide ADF’s efforts to deliver inclusive growth, strengthen resilience and unlock Africa’s potential as a global economic partner.